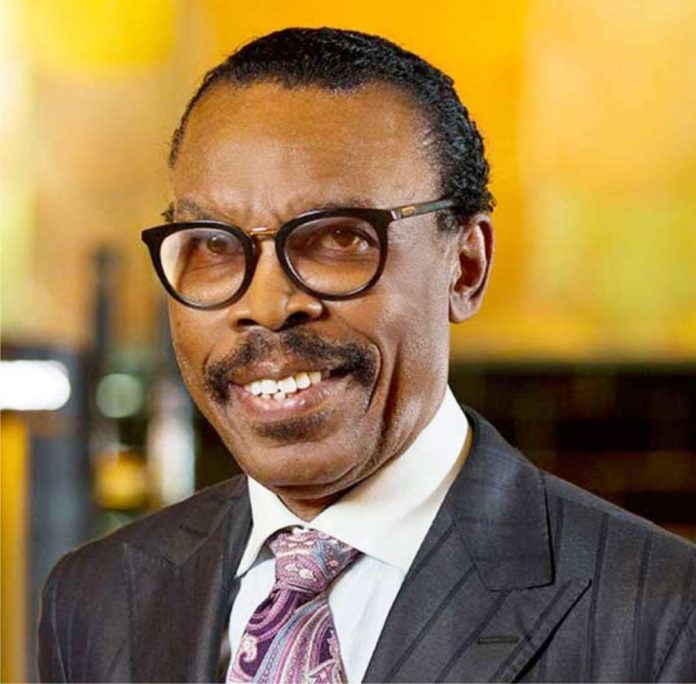

Nigeria’s aviation industry is losing altitude fast, shedding $3.5 billion in revenue between 2020 and 2022 due to poor infrastructure, inefficient operations, and fragmented market structure, according to foremost economist and Chief Executive Officer of Financial Derivatives Company, Mr. Bismarck Rewane.

Speaking in Lagos at the 29th annual conference of the League of Airports and Aviation Correspondents (LAAC), themed “Financing Aviation in Nigeria: Risks, Opportunities and Prospects”, Rewane painted a sobering picture of a sector in prolonged turbulence. He disclosed that the air transport sector contracted by 0.81% in the first quarter of 2025, the sixth consecutive quarterly decline, with domestic passenger traffic dropping for the second straight year to 11.5 million in 2024.

Despite Nigeria’s 32 airports, only 20 were considered viable last year, and an overwhelming 92–96% of passenger traffic was handled by just four. The industry’s fragmentation is stark: 23 active domestic airlines exist, but only five control 75% of the market.

Rewane also criticised the mismatch between airport spending and traffic levels. The Murtala Muhammed International Airport (MMIA), Lagos, Nigeria’s busiest, processes 6.5 million passengers annually but spends $1.75 billion to run, compared to Los Angeles International’s $3.5 billion spend for 76.5 million passengers, or Dubai International’s $4 billion spend for 92 million passengers. “We are spending like the big hubs, but without the passenger volumes to justify it,” he warned.

Amid government plans to spend ₦712 billion renovating MMIA’s old terminal, he called for privatisation of the terminal, allowing concessionaires to fund and manage upgrades. He cautioned against repeating mistakes made in the oil sector, where billions were sunk into non-performing refineries.

He also took aim at the recent trend of state governments launching airlines and building new airports without sustainable traffic demand. Examples include Ibom Air (Akwa Ibom, 2019), Cally Air (Cross River, 2021), Enugu Air (Enugu, 2025), and several state-funded airports opened between 2019 and 2024.

Rewane’s prescription was clear: consolidate airlines, prioritise concessions and Public-Private Partnerships (PPPs) for airport upgrades, invest in local maintenance, repair and overhaul (MRO) facilities, and focus government efforts on policy and regulation, not direct ownership or operation of airlines and airports. Policy consistency, he stressed, is vital for regaining investor confidence and attracting global aviation capital.